What is payment processing?

Contents

- Next-gen payment processing explained

- Understanding payments processing and its ecosystem

- What sets issuer processors apart?

- Why issuer processing matters for banks and fintechs

- What products can you launch with an issuer processor?

- Tips for choosing the right issuer processor

- Tools for evaluating your issuer processor

Next-gen payment processing explained

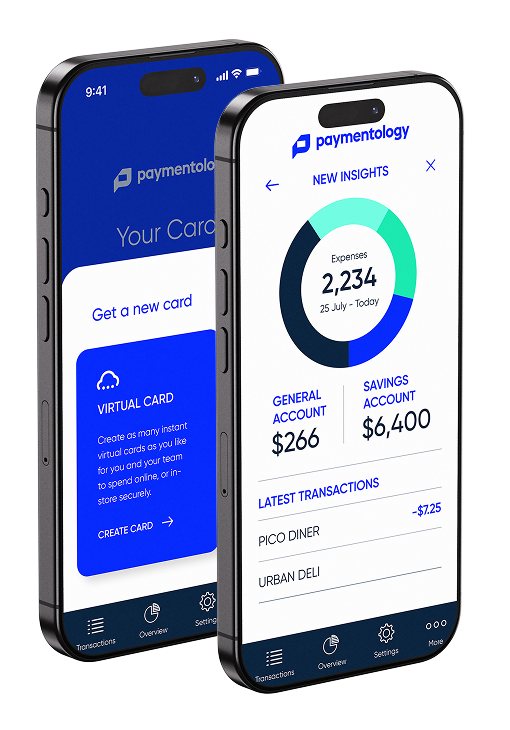

Payments are at the heart of every financial interaction, whether for consumers or businesses. From the ease of making and receiving payments to the security and speed of transactions, the experience affects both sides of every exchange. This guide dives deep into issuer-side payment processing—including issuing payment methods like physical and virtual cards and wallet-compatible solutions.

As consumer expectations and business needs evolve, legacy systems are no longer enough. Today’s environment demands speed, agility, enhanced security, and unmatched flexibility. Here, we explore the transformation of payments processing, the strategic choices involved, and how next-gen platforms like Paymentology help you stay competitive and future-ready.

Understanding payments processing and its ecosystem

Payment processing involves the authorisation, settlement, and transfer of funds between payer and payee. For issuers, understanding the players and roles within this ecosystem is essential:

- Issuers: Provide payment methods, enabling transactions.

- Retail and corporate banks: Traditional providers offering payment products.

- Fintechs and neobanks: Agile players, leveraging technology for innovative solutions.

- Schemes: Networks like Visa, Mastercard, UnionPay, and local networks (e.g., Mada in Saudi Arabia).

- Enablement partners: Key support entities, including KYC/KYB providers, credit bureaus, and card manufacturers.

- Issuer processors: Essential for handling transactions, these include:

- Traditional providers: Established companies transitioning to digital.

- Next-generation processors: Cloud-based, API-driven platforms (e.g., Paymentology).

- Specialised firms: Niche providers offering tailored program management solutions.

What sets issuer processors apart?

Issuer processors differ by technology, infrastructure and approach:

- Legacy processors: On-premises, high-cost solutions created for traditional banks.

- API-first platforms: Flexible, cloud compatible processors that emerged during the .com boom.

- As-a-Service providers: Distributors offering white-labelling and flexible deployment.

Key differentiators to consider:

- Technology & infrastructure: Cloud-first, scalable platforms like Paymentology provide open APIs for seamless integration, unlike legacy systems dependent on on-premises infrastructure.

- Speed to market: Quick go-live capabilities for launching new products faster.

- Global reach: Multi-currency and international support for cross-border transactions.

- Customer experience: Enabling frictionless, personalised digital experiences that meet modern expectations.

Why issuer processing matters for banks and fintechs

Building an in-house issuer processing solution requires a significant investment in infrastructure, development and maintenance. A dedicated issuer processor like Paymentology provides essential benefits:

- End-to-end orchestration: Streamlined partnerships and regulatory compliance.

- Reduced costs: Lower infrastructure costs with cloud-first systems.

- Innovation focus: Allowing banks and fintechs to focus on their core offerings.

What products can you launch with an issuer processor?

Partnering with an issuer processor allows you to introduce a wide range of customisable payment products:

- Debit, credit, and prepaid cards: Available as both physical and virtual cards.

- Highly customisable solutions: Tailored options for specific needs, from parent-teen cards to expense cards and more.

Next-gen platforms provide unparalleled configurability and rapid deployment—unlike legacy systems, which may charge high fees for program adjustments.

Tips for choosing the right issuer processor

Selecting the right issuer processor depends on your business model, goals, and growth stage. Here’s a breakdown of who might benefit from different types of processors:- Traditional banks: Often prefer legacy processors for high-volume support and compliance with stricter cloud policies.

- Spin-offs and greenfield projects: Gain from next-gen processors that offer agility and innovation.

- Digital banks and fintechs: Require advanced tech and control for co-innovation, fast product cycles and adaptability.

- Technology: Modern, flexible platforms that are cloud compatible.

- Expert support: Access to specialists who understand complex payment needs.

- Market presence: Proven expertise in your target regions.

- Compliance: Certifications and alignment with regional regulations.

Resources you’ll want to explore

Client Stories

Discover how leading digital banks and fintechs are transforming payments with Paymentology. From streamlined customer experiences to rapid global scaling, these stories reveal what’s possible when ambition meets expertise.

Reports

Stay ahead of the curve with insights that matter. Our reports dive deep into the trends shaping the payments landscape, offering expert analysis and actionable strategies to help you lead the way in a fast-changing world.

Blog

Gain fresh perspectives on the future of payments. From practical solutions to thought-provoking ideas, our blog is your go-to resource for staying informed and inspired in a rapidly evolving industry.

Interested in adding Paymentology to your evaluation process?

Submit an RFP today to explore how we can support your growth.