The Issuer Processor Fintechs Trust to Scale Payments Faster

Launch and scale your fintech card programme.

Without the complexity.

Fintech moves fast - but payments often don’t.

Regulations, banking infrastructure, and compliance roadblocks can delay your launch for months, even years. With Paymentology, you can issue and scale payment cards faster, without the complexity of securing a banking licence or direct scheme membership.

Powering fintechs worldwide

What’s holding fintechs back?

Fintechs move fast - however without the right payments partner, launching a card programme can turn into months or even years of delays, high costs, and compliance risks.

Licensing roadblocks

Securing a payment or banking licence and direct scheme membership can take years.

Regulatory complexity

Meeting KYC, AML, and PCI DSS requirements across multiple regions is a major challenge that requires deep security expertise.

Limited banking infrastructure

Traditional processors weren’t built for fintechs, lacking the flexibility and speed needed.

Scaling bottlenecks

Expanding into new markets requires deep local knowledge and real-time insights fintechs don’t always have.

Without a partner that understands fintechs, these barriers slow growth, increase costs, and make differentiation harder.

Trusted by leading fintechs

Processing billions of transactions annually

Operating in over 50 countries, across 14 time zones

Supporting fintechs that onboard millions of customers each year

Why fintechs choose Paymentology

Design a card proposition that maximises convenience and engagement, and unmatched user control

A successful card programme is more than just payments - it’s about creating seamless, engaging experiences that keep customers coming back.

Enable real-time card controls

for spending limits, security settings, and transaction approvals.

Provide seamless subscription

and spending management for a personalised, user-driven experience.

Integrate with digital wallets

Ensure smooth, effortless payments across Apple Pay, Google Pay, and Samsung Pay.

Give customers the confidence and flexibility to manage their money - on their terms.

E-book: The 3-Step Blueprint for Building a Successful Card Programme

Creating a winning card programme isn’t just about issuing cards. It’s about delivering convenience, control, and confidence to your customers.

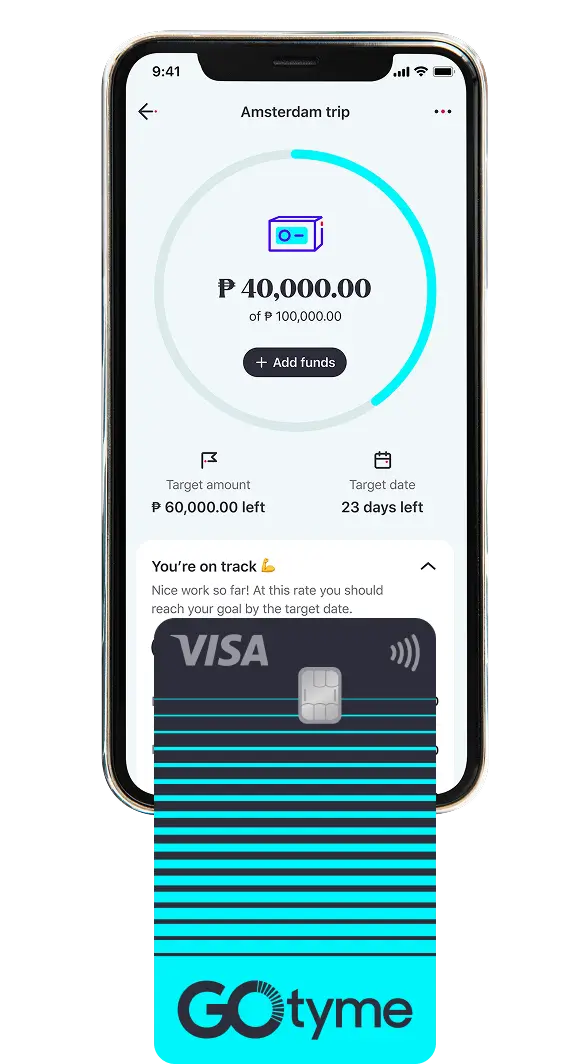

GoTyme Scales faster with Paymentology

GoTyme is revolutionising banking in the Philippines reaching a unicorn status. With Paymentology’s real-time issuing, they scaled fast - bringing seamless payments to millions.

GoTyme is revolutionising banking in the Philippines reaching a unicorn status. With Paymentology’s real-time issuing, they scaled fast - bringing seamless payments to millions.

With Paymentology’s real-time card issuing, GoTyme:

- Issued virtual and physical Visa debit cards in minutes

- Onboarded 1.7 million customers in six months

- Processed billions in transactions securely and at scale

Paymentology’s technology powers GoTyme’s growth, delivering speed, security, and scalability.

Ready to launch and scale?

Fintech moves fast - so should your payments. Partner with Paymentology and take your fintech to market faster.