As one of the Philippines' fastest-growing retail banks, GoTyme is transforming the financial landscape with its innovative “phygital” banking model.

With Paymentology’s next-generation card issuing technology, GoTyme combines the convenience of digital banking with the trust and accessibility of in-store touchpoints, making financial inclusion a reality across the Philippines’ unique archipelagic geography.

Key outcomes

7M

customers since launch

1,7M

onboarded in the first half of 2024 alone

PHP 17.3B

in deposits as of mid-2024

Leading the digital banking revolution in the Philippines

With digital banking on the rise globally, the Philippines is embracing this shift, and GoTyme is at the forefront. Designed for an underbanked population, GoTyme brings banking to communities with its “phygital” model, allowing customers to open accounts and receive debit cards instantly at high-traffic locations like supermarkets.

By combining digital efficiency with human interaction, GoTyme is reimagining financial inclusion for millions of Filipinos.

A unique approach to financial inclusion

GoTyme’s mission goes beyond traditional banking. Through in-store kiosks and the guidance of ambassadors, customers can open accounts in under five minutes, making banking both accessible and easy. This phygital experience creates confidence and trust, essential for first-time users of digital banking.

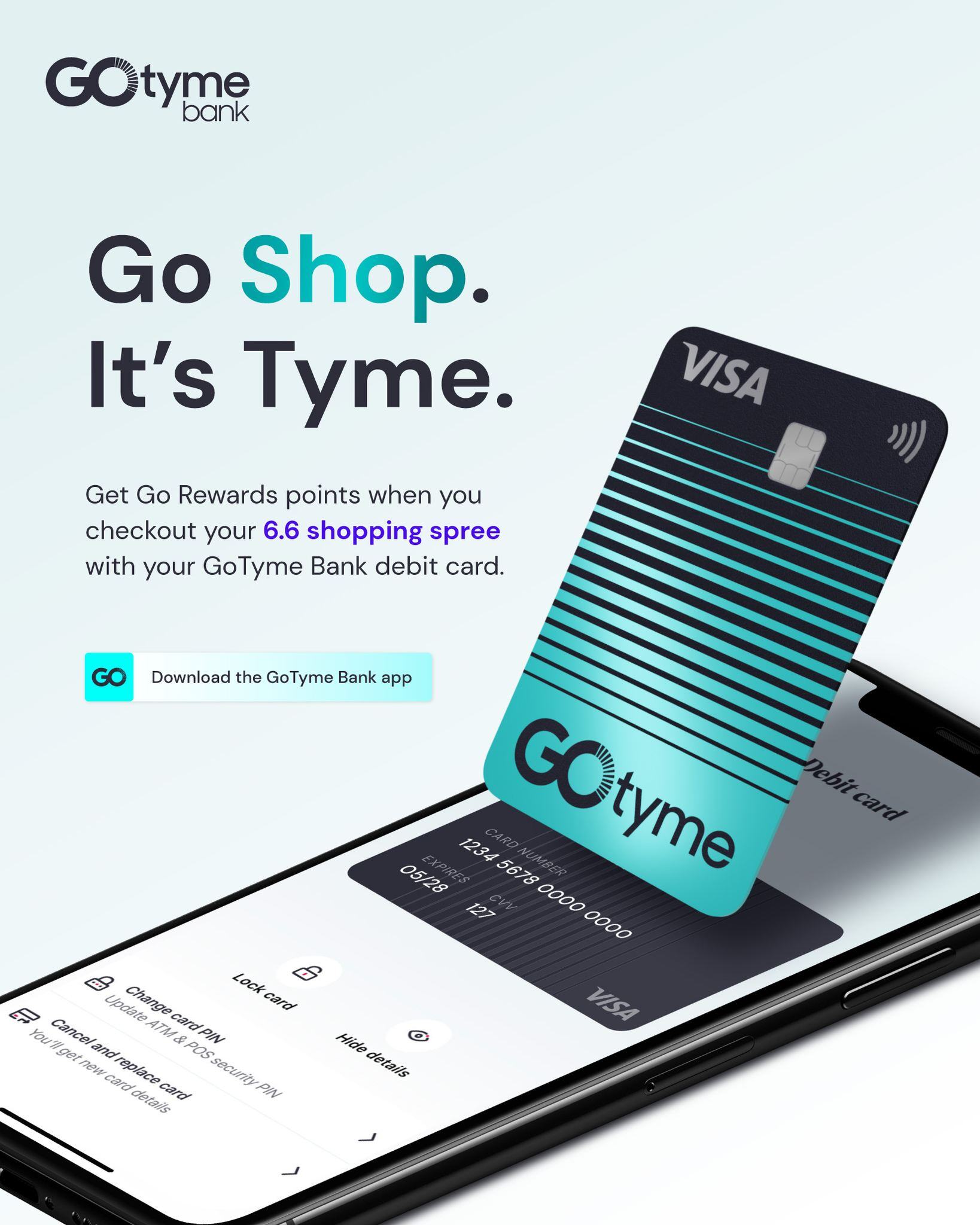

Integrated with the Robinsons rewards ecosystem, GoTyme also allows customers to earn rewards and benefits when they shop at a network of retail stores. This approach not only promotes loyalty but also makes everyday banking more rewarding for customers.

Remarkable growth and success

Since launching in 2022, GoTyme’s impact has been extraordinary. The bank has grown to serve 3.7 million customers, with 1.7 million onboarded in just the first half of 2024. GoTyme’s in-store kiosks drive the majority of this growth, with two-thirds of new users joining through this channel.

Beyond growth in customer numbers, GoTyme’s PHP 17.3 billion in deposits as of mid-2024 demonstrates the trust customers have in its services. Additionally, the bank reports a sevenfold increase in monthly app transactions, showing high engagement with its digital banking platform.

Powered by Paymentology’s real-time card issuing technology

GoTyme’s rapid growth is enabled by its partnership with Paymentology, whose real-time card issuing technology allows GoTyme to issue virtual and physical Visa debit cards in minutes within their mobile app or digital kiosks. This robust infrastructure supports high transaction volumes, delivering a fast, secure, and reliable banking experience for customers across online and offline channels.

Paymentology’s technology also provides top-level security, processing transactions with precision and ensuring that GoTyme can scale efficiently while maintaining customer trust and peace of mind.

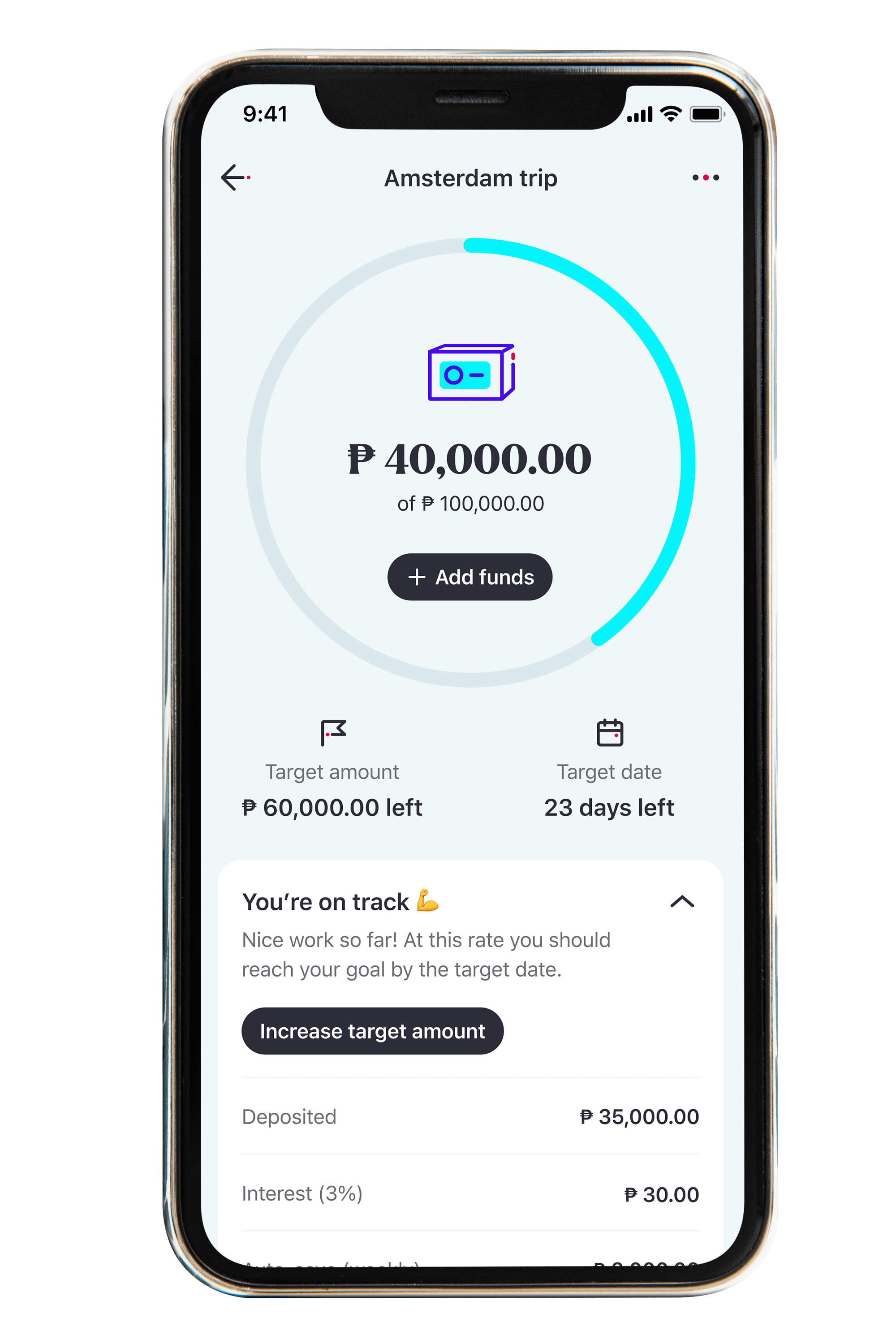

Expanding financial services to meet every need

Led by CEO Nathaniel Clarke and Co-CEO Albert Tinio, GoTyme is focused on scaling its operations to become the Philippines’ leading digital bank. On track to reach 5 million customers by the end of 2024, GoTyme is expanding its product offerings with new services like earned wage access (EWA), loan products for SMEs, and multi-currency time deposits.

“The more digital the world becomes, the more human our bank has to be,” says Co-CEO Albert Tinio, reflecting GoTyme’s commitment to a human-centered banking experience.

A vision for human-centered digital banking

As a leader in digital banking, GoTyme is dedicated to financial inclusion and believes that human interaction remains essential in building trust. With Paymentology’s advanced technology, GoTyme is reshaping banking in the Philippines by offering accessible, reliable, and customer-focused services that respond to the unique cultural needs of Filipinos. Together, they are not only changing banking but creating a new model for digital financial empowerment.