Diamond Trust Bank (DTB), a trusted leader in East Africa, is transforming how businesses access financial services in Kenya.

Through Cards-as-a-Service (CaaS) and Paymentology's advanced platform, DTB simplifies financial integration, unlocking growth opportunities and fostering inclusion across the region.

Key outcomes

Effortless card solutions

Businesses can quickly issue both virtual and physical cards, tailored to their needs

Financial empowerment

Payroll, expenses, and payments made simple for businesses and individuals

Driving regional growth

Supporting East Africa’s robust economic expansion, projected to exceed 5% annually

Redefining financial services across East Africa

Operating across Kenya, Tanzania, Uganda, and Burundi, DTB delivers innovative and customer-centric banking solutions to retail, SME, and corporate clients. By partnering with Paymentology, DTB empowers businesses, whether licensed or unlicensed, to issue cards for payroll, travel, and other key use cases.

This partnership simplifies compliance, allowing businesses to focus on delivering exceptional services while meeting Kenya’s stringent financial regulations.

"At DTB, we take pride in creating secure stores of value within a regulated framework and integrating systems seamlessly through simplified APIs. This partnership with Paymentology aligns with our digital transformation strategy and allows us to contribute to a more inclusive and advanced digital payment ecosystem in East Africa."

Jamie Loden, COO DTB

Driving innovation through Paymentology’s platform

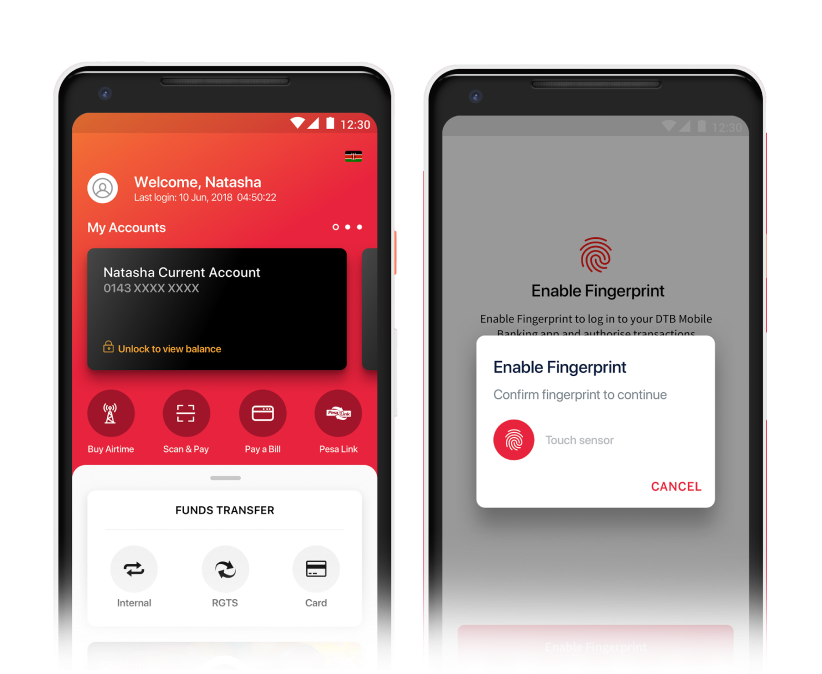

Paymentology’s platform is the driving force behind DTB’s ability to deliver comprehensive card solutions. By offering end-to-end card issuance, DTB provides businesses with both physical and virtual cards, all designed with advanced security features. The platform also incorporates cutting-edge technologies like tokenisation and 3DSecure, ensuring that every transaction is safe and seamless.

In addition, Paymentology accelerates time-to-market for card programmes, helping businesses activate their card propositions quickly and efficiently. This ability to scale rapidly empowers DTB to meet the diverse needs of its partners across the region.

"By partnering with DTB, we’re providing an expedited pathway for businesses to activate card propositions while contributing to the region’s growth and sustainability," says Kirsten Wortmann, Regional Director for Africa at Paymentology.

Transforming the digital economy

DTB’s embedded finance solutions come at a crucial time, as East Africa’s economy is poised for remarkable growth, with projections exceeding 5% annually. This creates an ideal environment for fostering financial inclusion and empowering businesses to access modern payment tools.

By breaking barriers to financial access, DTB enables small businesses to manage payroll, expenses, and transactions more efficiently, while individuals gain greater access to digital financial services. These efforts are helping to create a more inclusive economy, where opportunities are accessible to all.

Leading the charge in East Africa

DTB’s partnership with Paymentology is more than a collaboration, it’s a blueprint for how embedded finance can transform lives and economies. By empowering businesses to offer innovative financial solutions and enabling individuals to access services previously out of reach, this partnership is driving meaningful change across East Africa.

Together, DTB and Paymentology are not only advancing financial inclusion but also setting a new standard for economic empowerment in the region. Their efforts are building a future where secure, accessible, and innovative financial services become a cornerstone of East Africa’s prosperity.