Nomo, the first fully digital Sharia-compliant bank, is transforming cross-border banking by blending ethical principles with cutting-edge technology.

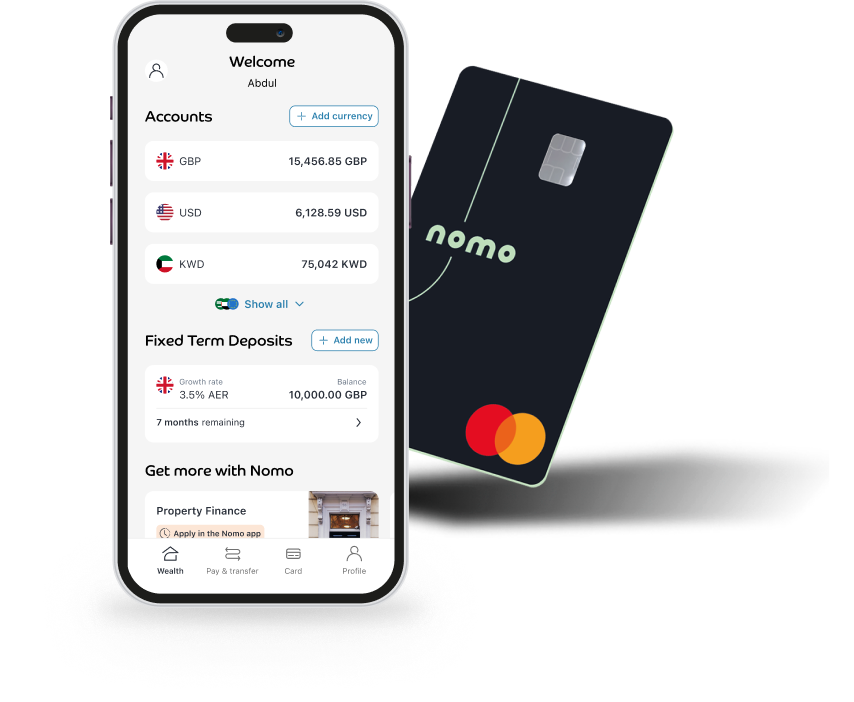

Backed by Boubyan Bank and BLME, Nomo empowers users with multi-currency accounts, seamless international transactions, and secure, flexible payment options, all through an intuitive digital experience.

Key outcomes

Multi-currency

Supporting GBP, USD, EUR,

KWD, AED, and SAR

X-border

Transactions offering reduced fees

Virtual cards

Ensuring secure and flexible payments

A digital pioneer in Sharia-compliant banking

Backed by Boubyan Bank and as part of Bank of London and The Middle East (BLME), Nomo leads the charge in digital banking with Sharia-compliant principles. With services spanning current accounts, property finance, and international transfers, Nomo combines ethical banking with cutting-edge digital tools, empowering users to bank confidently from anywhere.

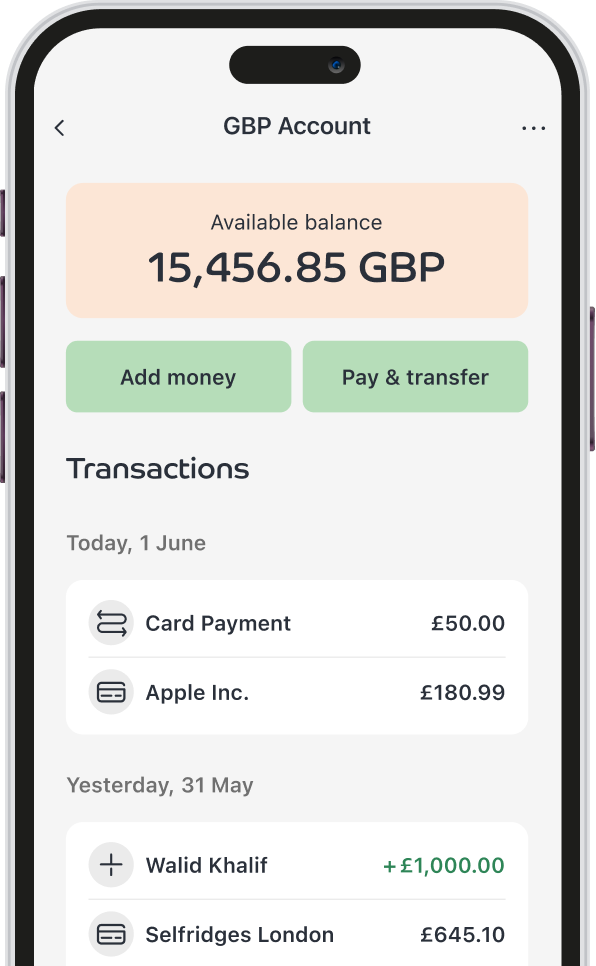

From its intuitive mobile app to seamless Apple Pay integration, Nomo’s offerings ensure that customers can manage their money with ease, anytime, anywhere.

Powered by Paymentology

Paymentology’s advanced technology plays a crucial role in Nomo’s journey, enabling:

- Faster processing: Transactions that are quick and reliable.

- Fraud prevention: State-of-the-art monitoring for a secure banking experience.

- Multi-currency accounts: Avoid costly exchange fees, a critical advantage as cross-border payments surged to over USD 390 billion globally last year.

"As the demand for Sharia-compliant digital products and services continues to grow, Nomo is at the forefront of delivering solutions that cater to the needs of Islamic customers and beyond. With our innovative payments technology, Nomo is paving the way towards a seamless, customer-centric, digital banking future. We look forward to launching more ground-breaking services together."

Martin Heraghty, Regional Director Europe of Paymentology

Driving innovation with data

Real-time data feeds allow Nomo to understand customer spending patterns deeply, refine their services, and provide unparalleled personalisation. Paymentology’s platform also supports robust fraud detection measures, adding a critical layer of security and protecting users during every transaction. This customer-first approach ensures their needs are met securely and efficiently.

“At Nomo, our customers want digital banking experiences that help them transact like a local wherever they are. Paymentology’s technology has helped us build a unique offering for our customers, helping them to conduct cross-border transactions without high fees, directly from the Nomo app. We remain committed to continuously developing innovative solutions and reimagining digital Sharia banking for everyone,”

Sean Gilchrist, CEO of Nomo.

The path forward

Nomo’s collaboration with Paymentology underscores a shared commitment to innovation and customer-focused digital banking. As demand for Sharia-compliant and cross-border banking solutions continues to rise, this partnership positions Nomo to lead the market with secure, accessible, and cost-effective financial services. Future plans include rolling out additional services that further enhance the customer experience and broaden financial inclusivity for users worldwide.