Rain, the global card issuing and payments platform built for stablecoins, is transforming payments around the world by bridging the gap between digital assets and fiat currencies.

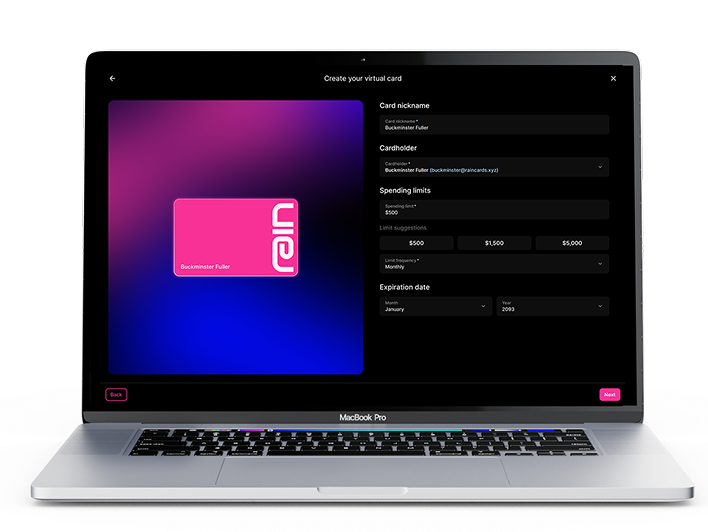

Together with Paymentology, they’ve introduced physical and virtual Visa credit cards, empowering consumers and corporate employees across Latin America and the Caribbean (LAC) to spend seamlessly.

Key outcomes

First-ever

Visa® credit card for Web3, bridging digital assets and payments

Flexible card offerings

Physical and virtual Visa credit cards enable interoperability with fiat currencies

Focus on LAC markets

Plans to expand globally using Paymentology’s API-driven infrastructure

Bridging digital assets and fiat payments

Founded in 2021, Rain has emerged as a leader in stablecoin-powered payments and spend cards for consumer and corporate programs alike. As a Web3-native company itself, Rain is designed to meet the unique operational needs of other Web3 organizations—enabling interoperability between digital assets and fiat currencies and providing worldwide merchant acceptance through Visa.

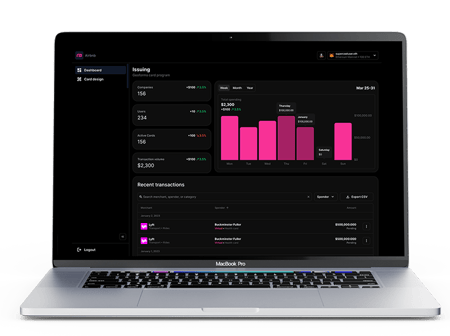

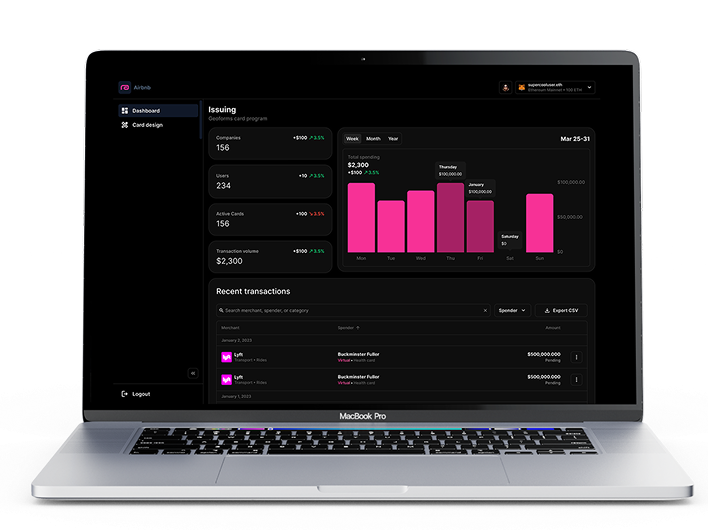

In partnership with Paymentology, Rain launched the industry’s first digital asset-compatible Visa credit cards, offering real-time transactions by integrating Rain’s onchain infrastructure with fiat payment rails. LAC, a region where crypto adoption represents 9.1% of global crypto value received, serves as the starting point for this transformative solution.

This focus on LAC is strategic, as the region’s high crypto adoption addresses the financial needs of unbanked and underbanked populations. By bridging the gap between digital assets and fiat, Rain offers businesses the opportunity to scale in emerging markets while enabling greater financial inclusion.

“At Rain, we take immense pride in being the pioneers of a solution that combines onchain infrastructure and interoperability with fiat rails for the digital asset ecosystem. Our collaboration with Paymentology has enabled us to service some of the largest stablecoin-powered card programs around the world. With the support of Paymentology's reliable solutions, we’re excited to offer our solutions to our valued customers,” said Farooq Malik, CEO and Co-Founder of Rain.

Leading the way with industry-first technology

Paymentology’s cloud-first, API-driven issuer processing platform has been instrumental in Rain’s success. By powering both physical and virtual Visa credit cards, Paymentology enables real-time crypto-to-fiat transactions, making it easier for Web3 teams and consumers to use digital assets at any merchant accepting Visa. Key features include:

- Fiat interoperability: Crypto-to-fiat spending in real-time.

- On-chain integration: Seamless alignment with Rain’s settlement technology.

- Global scalability: API-driven infrastructure ready for international growth.

“With around 70% of Latin America’s population considered unbanked or underbanked, it comes as no surprise that crypto adoption has surged in this region,” shared Alejandro Del Rio, Regional Director for Latam at Paymentology. “We are delighted to achieve this industry-first milestone with Rain, and we look forward to advancing financial solutions in the Latam fintech industry and beyond.”

Expanding beyond Latin America

Rain’s initial focus on the Latin America and Caribbean region is only the beginning. Leveraging Paymentology’s API-driven infrastructure, Rain is set to scale its groundbreaking solution globally, aiming to become the go-to stablecoin-powered payment platform worldwide. This partnership underscores the transformative power of fintech in driving accessibility and innovation across borders.