By transforming a transport card into a powerful financial tool, the partnership helped the government deliver essential relief, fast. Together, we created a digital solution already in people’s hands. No learning curve. No added complexity. Just real help, delivered when it mattered most.

During the height of the COVID-19 pandemic, Octopus and Paymentology came together to support millions across Hong Kong.

Key outcomes

Open-loop prepaid cards

Enabled fast, secure disbursement of COVID-19 aid across Hong Kong.

Easy everyday spending

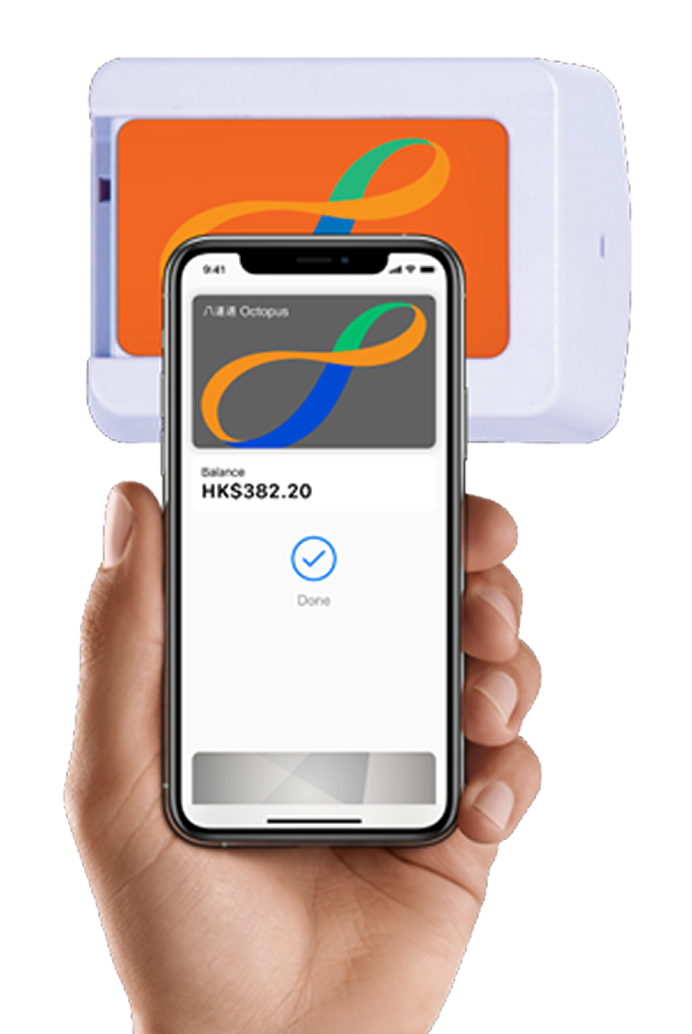

Relief funds were accessed directly through the Octopus app for daily essentials.

Loyalty that lasts

Rewards encouraged continued use and built lasting trust.

From commuter card to everyday companion

Originally built for transport fares, the Octopus card is now part of daily life in Hong Kong. It is used by 98% of residents aged 15 to 64 across hospitals, shops and schools.

During the pandemic, it became something even more important: a lifeline. In partnership with Paymentology, Octopus enabled the government to deliver relief funds directly into digital wallets, instantly ready to spend where people needed them most.

Infrastructure that supports real lives

Paymentology powered the infrastructure behind the rollout, ensuring:

- Instant wallet top-ups for critical government support

- A secure, compliant platform trusted by millions

- Simple multi-account management to support families and households

The result: a solution that reached people fast, was easy to use, and became part of daily life across the city.

Partnerships with real impact

This story is about more than payments. It is about access.

Octopus and Paymentology combined deep trust, local reach and real-time technology to help people when they needed it most.

As cities across the world move toward cashless futures, Hong Kong is showing how to do it right, with tools that fit into daily life and partnerships built to last.