Founded in 2016, albo has become a trailblazer in Mexico’s fintech scene, providing a modern alternative to traditional banking.

With over 2 million users and $6.5 billion in annual transactions, albo is breaking barriers to financial inclusion. Its strategic partnership with Paymentology is central to this journey, delivering scalable, secure, and innovative payment solutions that fuel albo’s rapid growth.

Key outcomes

+2 million

users benefiting from accessible digital banking

$6.5 billion

(USD) in annual transaction volume processed

$60 million

(USD) credit line secured for sustainable growth

Driving financial inclusion in Mexico

In Mexico, where nearly 30 million people lack access to formal financial services, fintechs like albo are vital. With the digital payments market projected to grow nearly 10% annually by 2028, the demand for inclusive, user-friendly banking solutions is urgent. Albo’s mission is to bring millions of Mexicans into the financial system while empowering SMBs with essential financial tools.

“Our partnership with Paymentology represents a powerful alignment of our shared commitment to financial inclusion and to accelerating Mexico’s digital economy. Together, we’re working to make secure, accessible financial solutions available to millions across the country, empowering individuals and small businesses alike. Paymentology’s customer-centric approach and expertise have made them a natural cultural fit with our team at albo, enhancing collaboration and fueling innovative solutions that make a real difference for our users.”

Ángel Sahagún, CEO and founder of albo

A strategic partnership for scalable growth

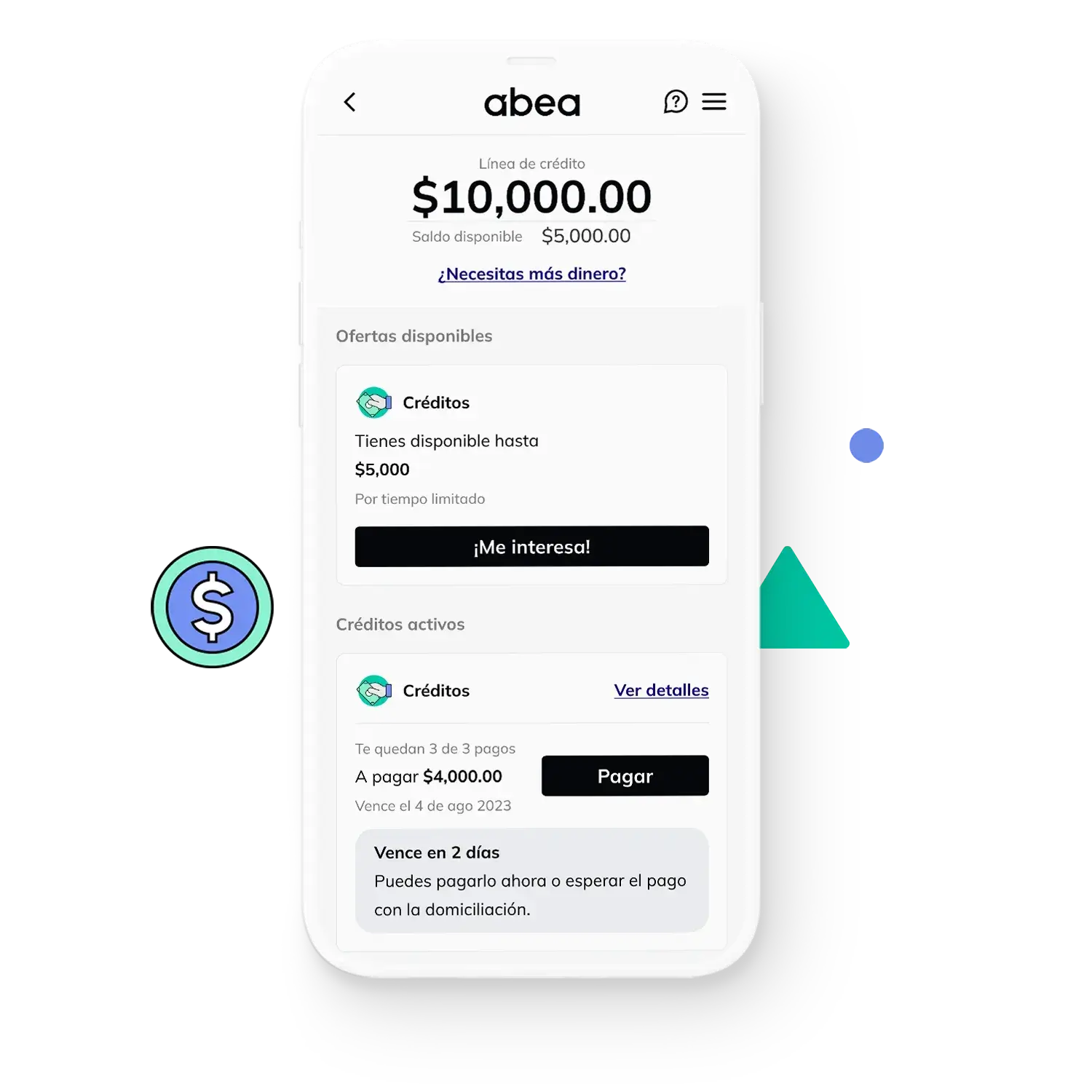

To achieve its ambitious goals, albo partnered with Paymentology, tapping into advanced payment processing capabilities. Features like dynamic CVV checks, 3D Secure technology, and instant card activation power albo’s secure and scalable platform for millions of users.

“Throughout 2023, albo achieved remarkable growth, driven by increased customer acquisition and transaction volumes, while maintaining healthy unit economics,” says Alejandro Del Rio, Regional Director for Latam at Paymentology.

Empowering small businesses in Mexico

Albo, with Paymentology’s support, has introduced dedicated financial services for small and medium-sized businesses (SMBs). From payroll management to secure transaction tools, these solutions empower SMBs to streamline operations and focus on growth.

This strategic addition has generated widespread interest, exceeding early expectations and positioning albo as a go-to digital banking partner for Mexico’s SMB sector.

Enhancing everyday banking for retail customers

Albo’s retail customers have experienced unprecedented convenience with the introduction of 400 top-up points across the country. These points allow users to load cash onto their cards at no cost, making digital banking accessible for millions.

With enhanced fraud protection measures, including dynamic CVV checks and 3D Secure (3DS) technology, albo ensures transactions are secure, bolstering customer trust and satisfaction.

Accelerating Mexico’s digital payment revolution

With nearly 10% annual growth projected in Mexico’s digital payments market from 2024 to 2028, albo and Paymentology are driving the next wave of financial inclusion. Together with Mastercard, albo is rolling out initiatives designed to boost digital payment adoption, offering incentives such as scholarships, cash prizes, and exclusive rewards to empower more people to embrace cashless solutions.

Through this partnership, albo continues to transform financial access across Mexico, creating opportunities and empowering millions to participate in the digital economy.