Paymentology

2-10-25

While the card payment industry in the Netherlands presents strong opportunities for local banks, issuers should also be cautious of potential threats.

The Netherlands is a country that seldom releases any official reports about credit card spend, although its payment industry relies heavily on debit cards. According to Global Data, debit cards accounted for 95.5% of card payment volumes and 87.4% of card payment value in the country in 2023

While Dutch citizens are averse to debt, they are very willing to embrace new payment technologies. The number of contactless cards in circulation grew from 26.5 million to 39.4 million between 2019 and 2023, partly due to the Covid-19 pandemic and the Netherlands was one of the first countries in the world to introduce a fully contactless payments system on its public transport network. Some 91.4% of debit card transactions were contactless in January 2024, rising from 87% in 2021.

Overall, card payments account for 47.5% of all payments in the Netherlands, with cash payments now under 10%. Cards are used for payments of both low and high value, though most purchases for high-value items are made on credit card or charge card. Debit cards account for most purchases of food & drink and motor fuel.

In terms of scheme, Mastercard dominates the Dutch debit card market, with 97.2% of total debit card transaction value in 2023. ING Bank is the leading debit card issuer with 11.6 million cards in circulation, closely followed by Rabobank at 10.3 million and ABN AMRO at 7.5 million.

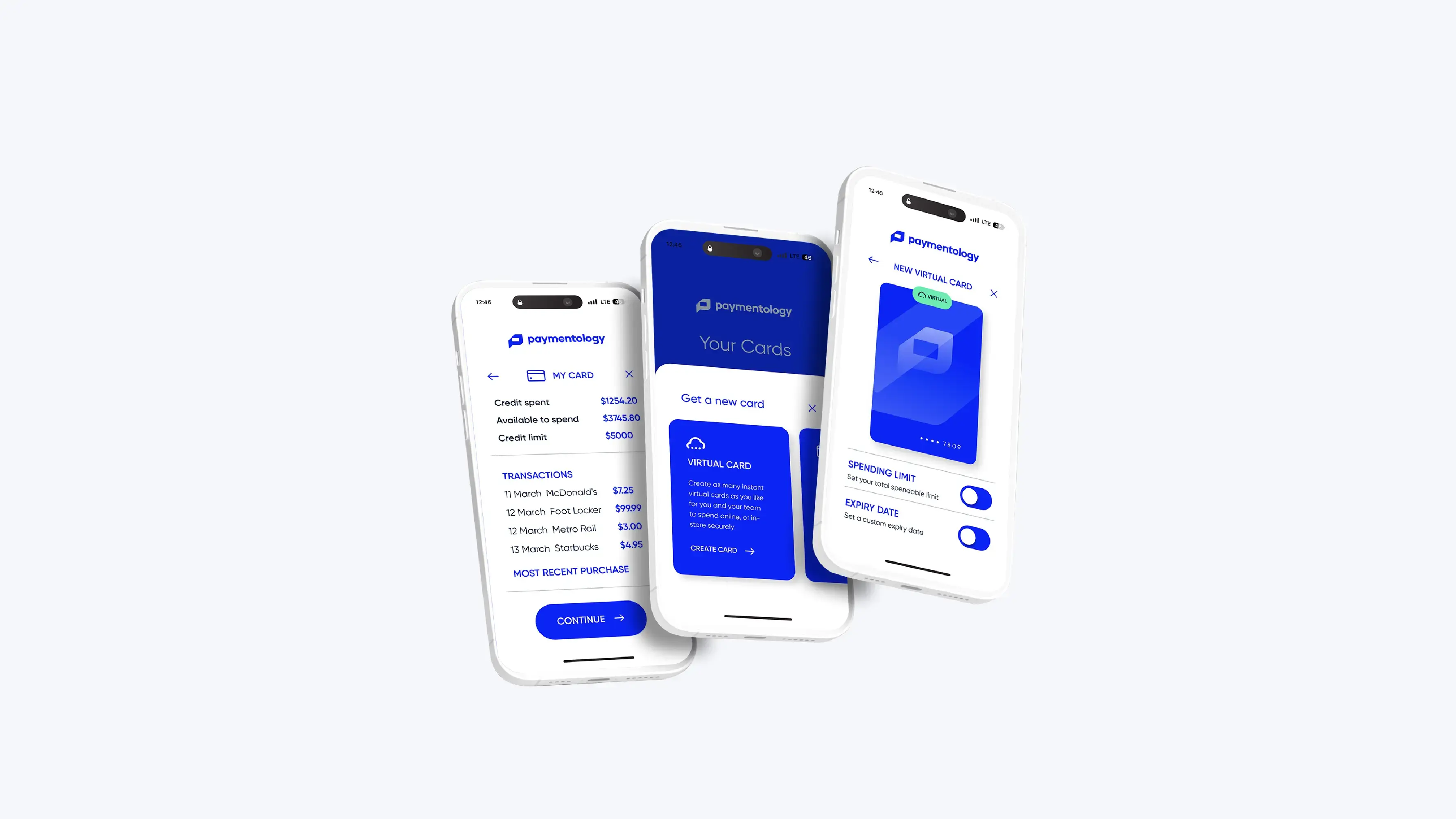

Mobile wallet payments in the Netherlands are very much at a transitional stage. Global Data's survey found that mobile wallets have a low usage compared to contactless cards, while 46% of Dutch consumers said they had a mobile wallet, one-third of them had not used it in the previous month. Just over 30% said they were not interested in getting a mobile wallet. However, according to data from Statista, digital wallets will account for over a third of in-store transactions by 2027.

A worrying trend for banks in the Netherlands is that nearly a quarter (23%) of Dutch people have not set a daily spending limit for either their debit card or their current account, according to a 2023 survey by ABN AMRO and Ipsos. Millions of Dutch people re-use their PIN codes, according to a separate survey, and earlier this year Rabobank were told to pay €100,000 to a couple who were victims of card fraud.

Issuing banks in the Netherlands need to be wary of the threat of card fraud. As such, they should demand the highest level of protection from their payment partners.

At Paymentology, we equip neobanks and fintechs with the tools to stay one step ahead of criminals. Our role is to provide real-time checks, a configurable rule engine and alert monitoring, while the rules and actions are yours to set.

If you want to find out more about how Paymentology can help your institution, get in touch today.

/Blog4_Understanding-the-features-of-mobile-wallets.jpg)