Wio Bank PJSC, the UAE’s first platform bank, is transforming financial services for SMEs, freelancers, and individuals.

Partnering with Paymentology, Wio delivers tailored, seamless banking solutions that empower businesses and individuals to thrive.

Key outcomes

2 million Dh

Profit in its first full year of operations in 2023

50,000+

SMEs onboarded to Wio Business and 40.000 to Wio Personal

63.5%

Contributed to the UAE’s non-oil GDP by SMEs

Revolutionising SME Banking in the UAE

The UAE is home to a vibrant SME ecosystem, with 557,000 small and medium enterprises contributing 63.5% to the non-oil GDP as of mid-2022. With projections estimating 1 million SMEs by 2030, Wio is strategically positioned to support this critical sector.

In partnership with Paymentology, Wio addresses long-standing challenges for SMEs, enabling frictionless account setup and access to essential financial tools. Paymentology’s advanced platform provides real-time insights into customer spending, empowering Wio to refine and enhance its offerings to meet the evolving demands of the UAE’s business landscape.

"Our collaboration with Paymentology is a game-changer for SMEs, a vital economic segment in the UAE. With Paymentology’s support, we’re able to offer comprehensive, personalised card services to Wio Business customers, equipping them with the insights and tools they need to succeed."

Jayesh Patel, CEO of Wio Bank PJSC

Driving rapid growth and profitability

Launched in September 2022, Wio achieved profitability in its first full year of operations in 2023, recording Dh2 million in profit on revenues of Dh266.4 million. This milestone positions Wio among the fastest neobanks globally to reach profitability.

Customer deposits surpassed Dh11 billion during the year, reflecting the market’s strong confidence in Wio’s services.

"In less than two years, we have built the foundation of a tech-native, digital banking platform that caters to the needs of individuals and businesses for simpler, more accessible, and more intuitive financial services," shared Salem Al Nuaimi, Chairman of Wio Bank.

Delivering innovative solutions with Paymentology

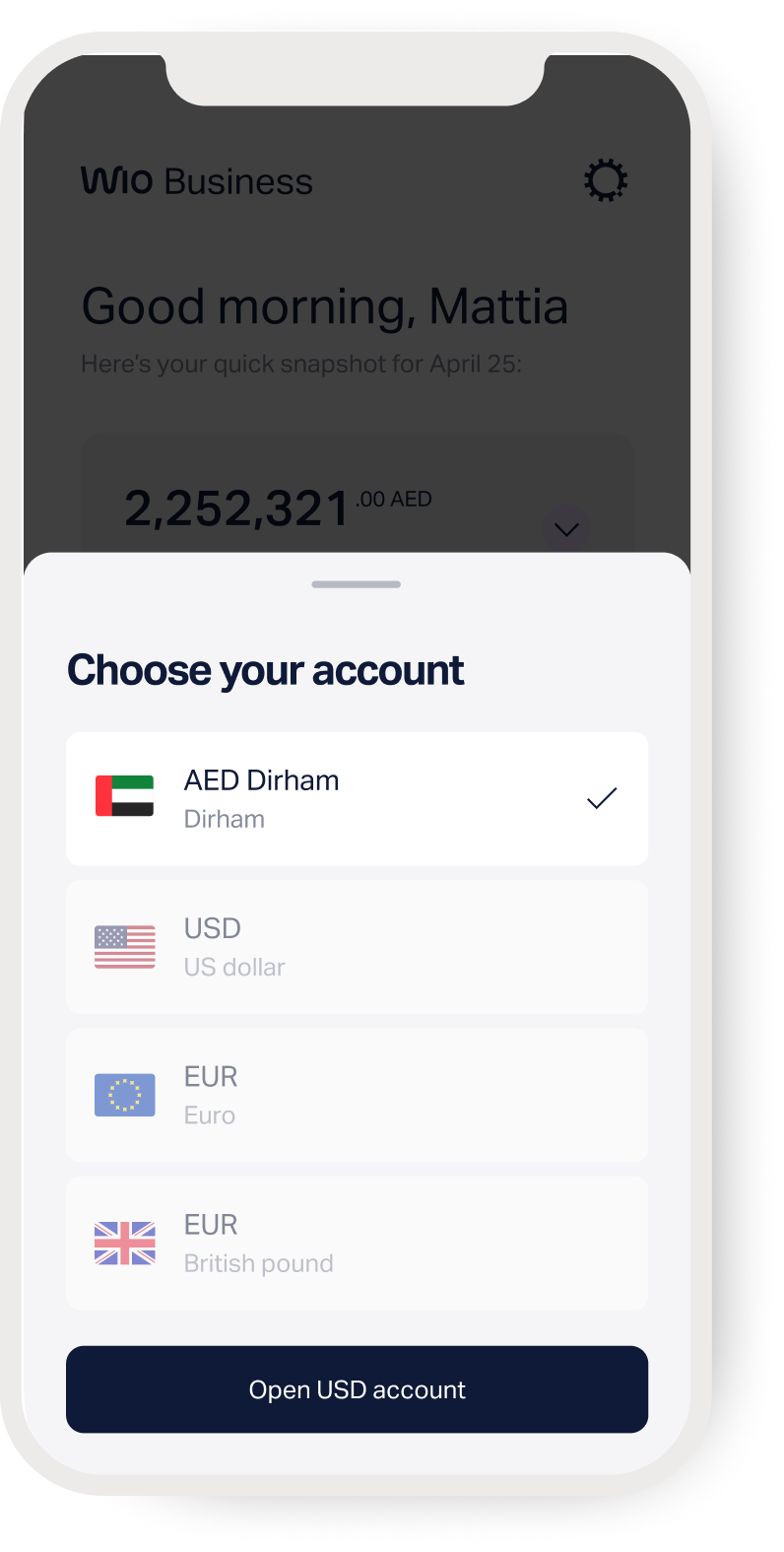

Powered by Paymentology’s cloud-native payments platform, Wio Business provides a robust suite of services, including:

- Multi-currency accounts: Simplifying cross-border business transactions.

- Wage Protection System (WPS): Supporting compliance with UAE labour requirements.

- SME web app: Offering digital tools tailored to small and medium enterprises.

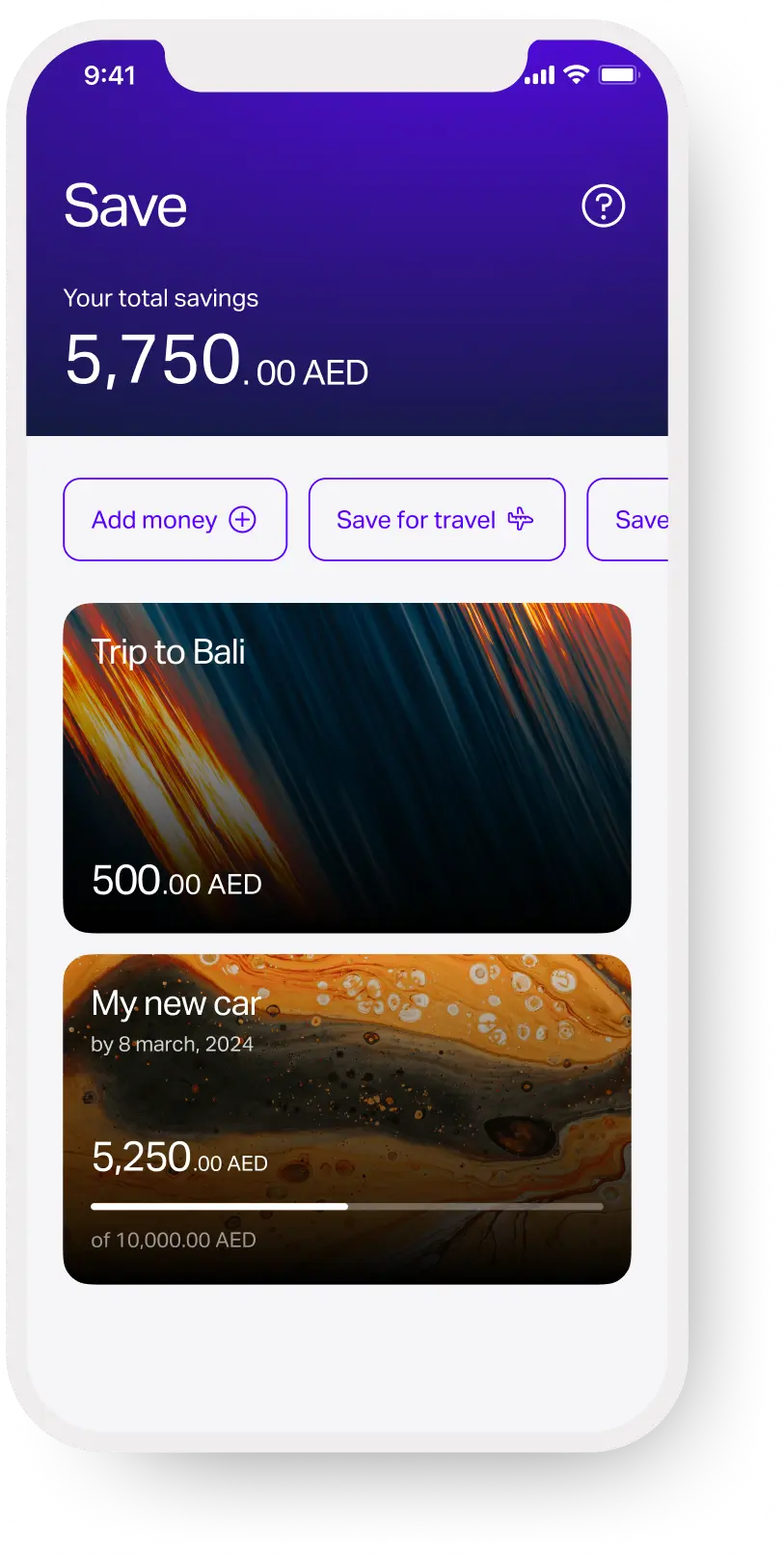

By the end of 2023, these features had attracted over 50,000 SME customers, further solidifying Wio’s position as a leader in SME banking. The Wio Personal platform has also seen remarkable success, onboarding over 40,000 customers and accumulating more than Dh6 billion in deposits during the same period.

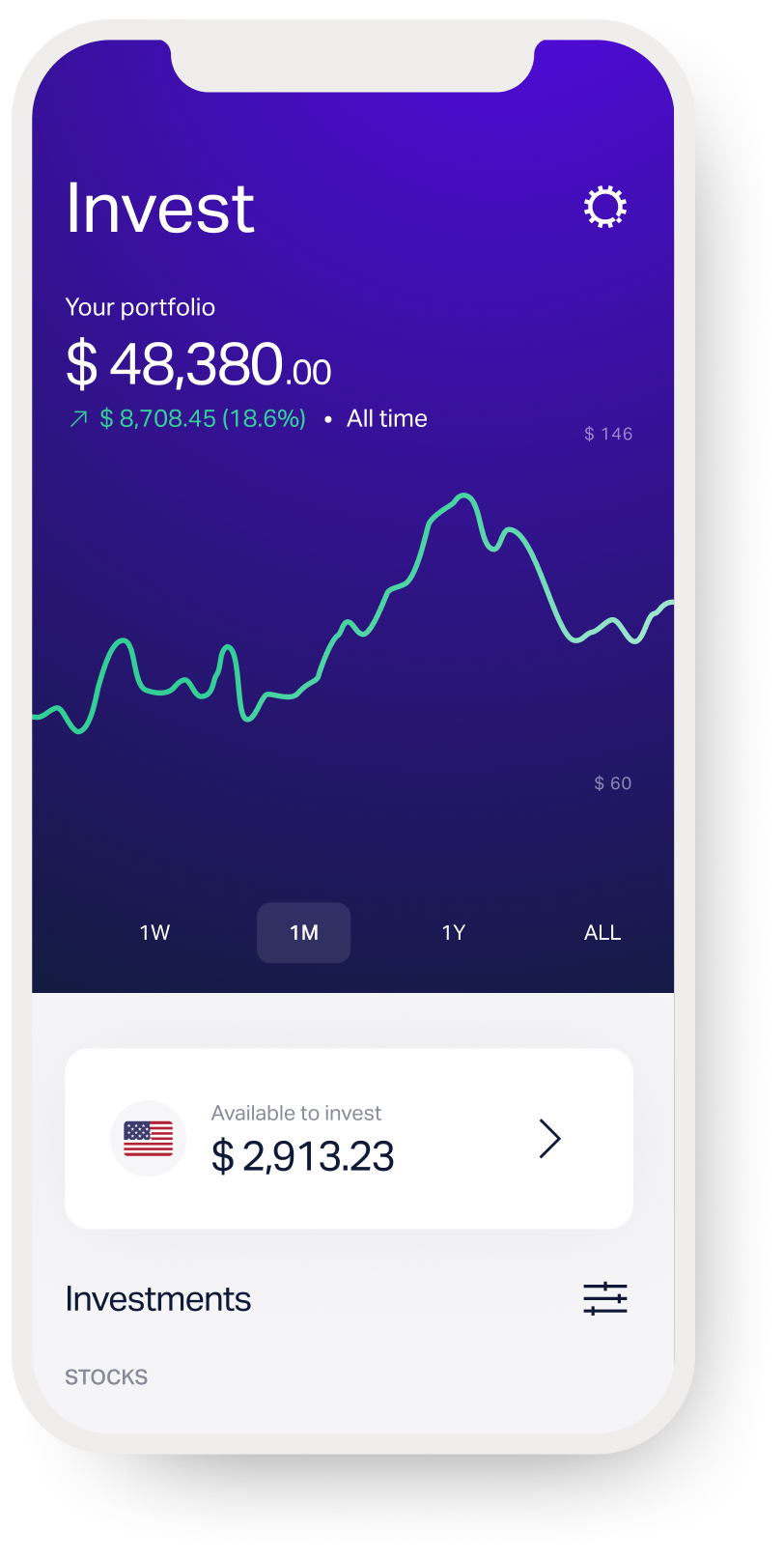

Expanding financial inclusion and innovation

With Paymentology’s advanced platform, Wio has broadened its services to include retail banking, delivering essential financial tools to individuals across the UAE. This partnership continues to foster financial inclusion and economic growth by making banking services accessible and user-friendly for all.

Together, Wio and Paymentology are actively working to expand their impact in the UAE, rolling out new services tailored to both business and retail segments. With a shared commitment to innovation and customer-centricity, they are building a digital financial foundation that supports the UAE’s growth and development.

As Wio and Paymentology continue to innovate, they are setting new benchmarks in digital banking, positioning the UAE as a global leader in financial technology.