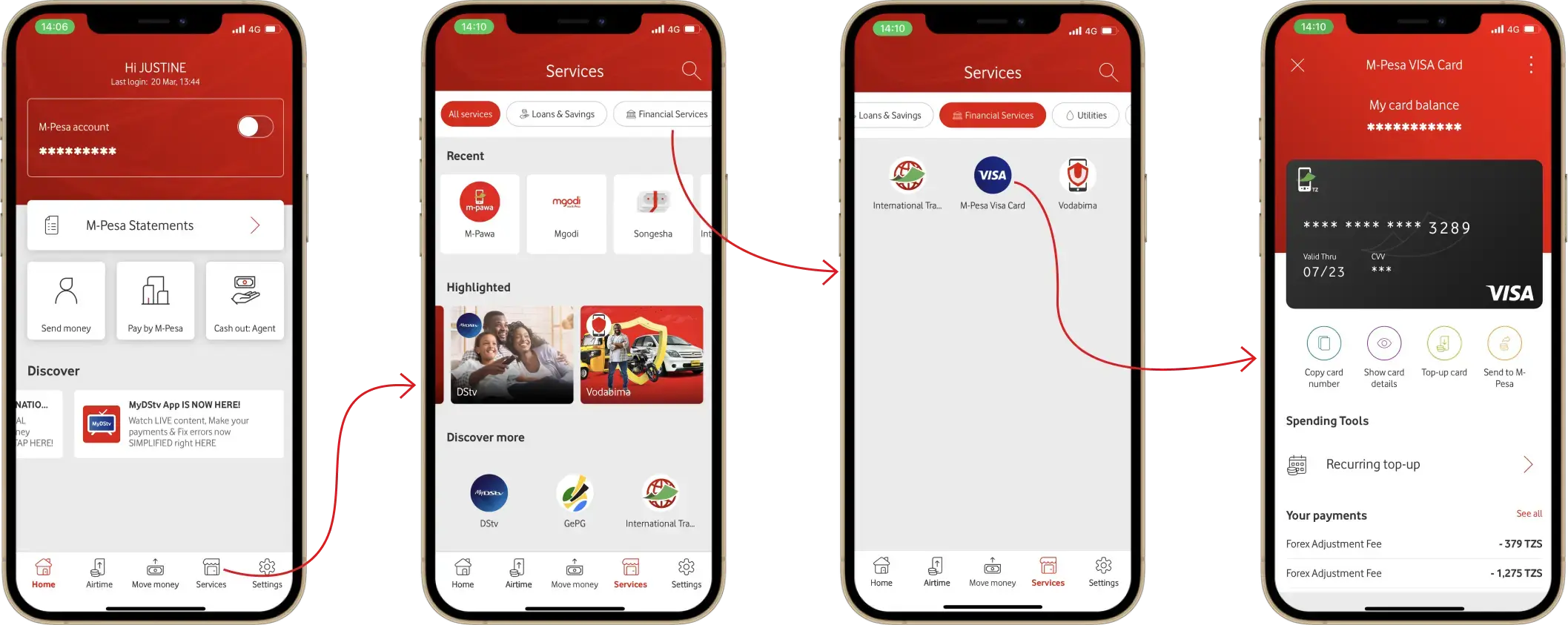

Safaricom PLC, one of East and Central Africa’s leading companies, partnered with Paymentology to launch the GlobalPay Virtual Visa Card.

This breakthrough empowers 30 million M-PESA users to shop, pay, and transact internationally, connecting them to the global economy and advancing financial inclusion. In 2022, M-PESA processed over 15.7 billion transactions, cementing its role as a trusted financial lifeline for millions.

Key outcomes

100.000's

Virtual cards issued within the first month

30+ million

M-PESA users enabled to transact globally

15.7+ billion

transactions processed in 2022

Bridging local and global commerce

For over 20 years, M-PESA has been a cornerstone of financial inclusion in Kenya. Recognising the growing need to connect users to the global economy, Safaricom partnered with Paymentology to deliver a secure virtual card that seamlessly integrates with the M-PESA ecosystem.

This breakthrough empowers users to make international payments for ecommerce, subscriptions, and in-store transactions, eliminating barriers to global commerce and opening new opportunities for millions.

Delivering impact at scale

From rapid adoption to sustained growth, the results speak volumes:

- Hundreds of thousands of virtual cards issued within the first month

- Over 1 million cards activated by 2023

- 3+ million businesses empowered by M-PESA globally

Powered by Paymentology’s real-time transaction processing and advanced card management tools, Safaricom has transformed M-PESA from a local wallet into a gateway to global payments offering new opportunities to millions.

A future of boundless possibilities

As M-PESA continues to push the boundaries of innovation, its partnership with Paymentology ensures it remains at the forefront of secure, scalable, and customer-first global payment solutions.

Together, Safaricom and Paymentology are not just connecting Kenyans to the world, they’re fostering inclusion, expanding opportunities, and building a future where millions thrive in the global economy.