Bulent Dal

6-07-23

It's no exaggeration to say that telecommunication companies have played a key role in transforming the world since the early 2000s. The subsequent rise of smartphones and mobile internet technology has revolutionised the telco industry. Almost every aspect of life as we know it, for more than 5.4 billion active mobile users worldwide, relies on telco services as the foundation for what is today considered the connected “normal”.

Through the same technological and social evolutions that have seen telcos grow vast and enviable user bases, a new set of challenges has arisen, with price compression and market stagnation in many areas. For example:

Some telcos have responded to the challenge by seeing the opportunity to diversify through providing their customer bases with services that solve other real-life challenges far beyond simply making calls, sending messages and connecting to the internet. The convergence of telecommunications, financial services (FS) and banking has created a massive opportunity for telcos to do just that – create new revenue streams, fulfil real needs faced by their customers, and build stickiness and loyalty in the process. Innovative telco players have bridged the gap between telecommunications and the FS markets, securing access to sizeable portions of their $6.1 trillion and $2.1 trillion 2021 global revenues respectively (with the latter set to reach up to $3.3 trillion by 2026).

With the global volume of non-cash transactions seeing a year-on-year growth of 17% in 2022, the demand for alternative payment methods has grown substantially, and seems set to continue doing so. Digital wallets, QR codes, and P2P transfers have become ubiquitous worldwide. Africa has played a pioneering role in this evolution. Asia-Pacific is leading the uptake charge so far, with almost half of the global volume. Other regions throughout the world are seeing similar patterns emerge, and with them, a wide range of opportunities to capitalise for those with the foresight to be in the right place, at what is now most certainly the right time.

One area where telcos have a significant advantage over other emerging players in the digital FS space is in the sheer number of their customer bases. While many new entrants into the market such as digital or neo-banks have made undeniably impressive strides, most still face notable challenges. These include high customer acquisition costs, with the additional risk of hard-won new customers signing up and turning dormant early in their life cycle. Newer players also often lack the data insights necessary to offer highly personalised services and products. To many potential customers, their brands are perceived as “new”. And, while this shines a positive light in terms of innovation, it also diminishes trust in the eyes of many who seek stability and long-term track records from their FS providers.

Established telcos enjoy a sizeable upper hand in many of these areas. Most are deeply entrenched, with customer bases well into the millions, access to detailed insights into consumer behaviour, and strong brand-perception gravitas. In short, they have their potential FS markets already on hand, they understand their habits and needs, and they’re seen as concrete pillars of industry; foundational to the infrastructure of the regions in which they operate. Telcos have their marketing channels firmly in place, and the ability to reach their audience inherently built in through the very nature of what they do at their core.

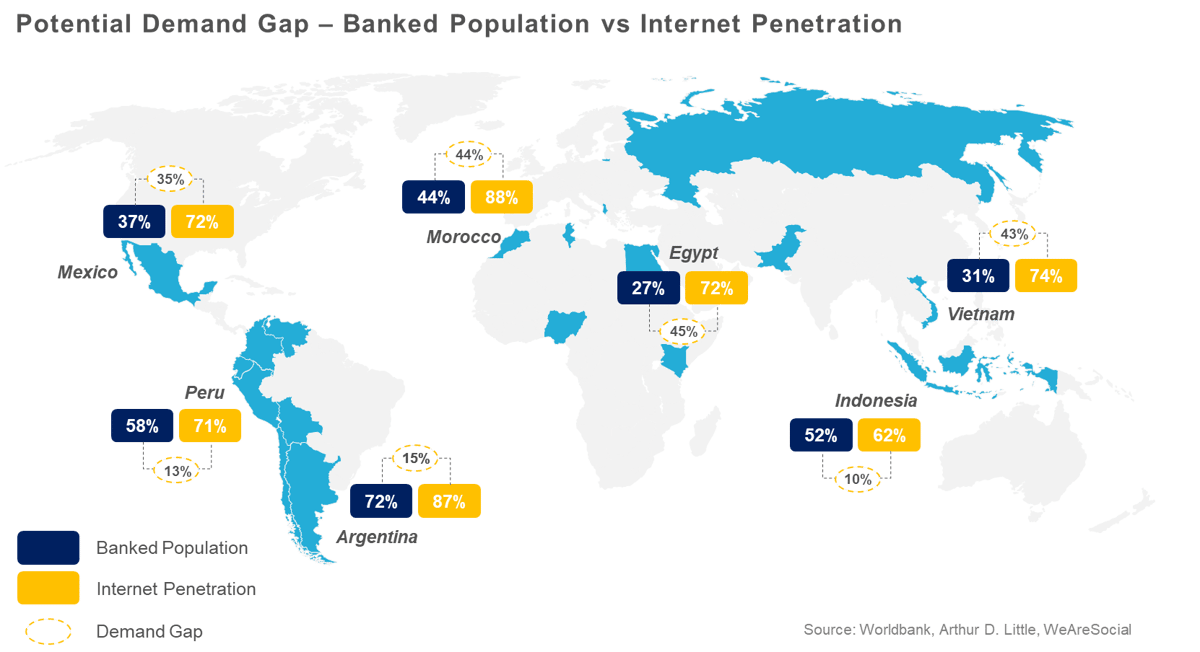

Another strong argument for telcos to enter the FS space is the ability to address the issue of financial inclusion, particularly in developing countries. In many regions, there remains a significant gap between relatively high levels of access to internet and mobile services, and worryingly low levels of access to formal financial services, for large portions of many global populations. Where formal banking infrastructure and access is limited or even non-existent, mobile infrastructure and reach is often far more developed.

Telcos can address a significant disparity between banked individuals and internet penetration rates across various countries

By offering financial services such as mobile wallets, bank accounts, virtual and physical cards, credit, insurance and others, telcos have an opportunity to change lives for the better and drive whole economies forward, whilst opening significant revenue streams, attracting new customers, and growing existing customer loyalty in the process.