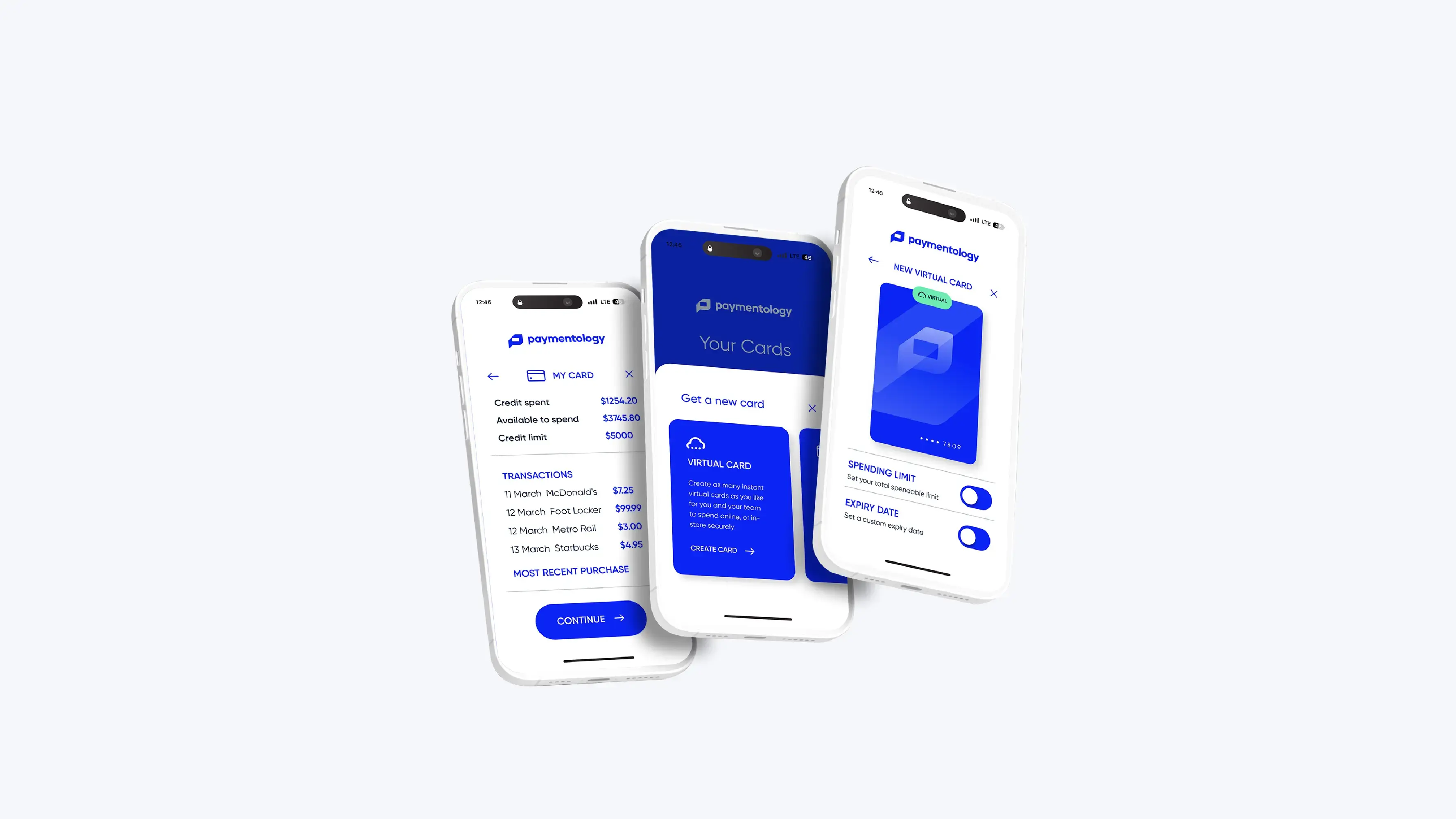

Paymentology

26-04-21

The good news is that banks can significantly ramp up their fraud prevention controls through advanced analytics at the payment processor level. AI can let banks spot suspicious transactions at the point of transaction.

With a technology-first approach, banks can improve detection of unusual behaviours that fall outside of expected customer activity profiles and build more effective fraud defences. They can also use the same technology to drive more customer-centric banking services that are fit for the modern age.