Fondeadora is a digital financial services provider in Mexico that aims to address the shortcomings of the conventional banking system. Through its advanced app, both individual and corporate clients can use, save, and manage their money more efficiently. As part of a new collaboration, Fondeadora is leveraging Paymentology's cutting-edge cloud-based digital payment platform to deliver a seamless payment experience to its customers. By doing so, Fondeadora can offer faster transaction processing, advanced security measures, and enhanced data analytics.

This marks a significant achievement for the partnership as Fondeadora has become one of the front-runners in Mexico to offer its customers the convenience of using their debit card through their Apple Wallet. With this feature, cardholders can quickly and securely make payments online or in-store with participating merchants who accept this payment method.

Jorge Fernández General Manager at Fondeadora commented: “We’re incredibly proud to be one of the first financial institutions in Mexico to bring Apple Pay to our customers. Without the help of our steadfast issuer-processor partner, Paymentology, we wouldn’t have been able to launch such a dynamic service. We look forward to our continued relationship with the expert team at Paymentology and creating many more industry milestones.”

Fondeadora’s launch of Apple Pay is a significant step forward in providing the latest and most innovative financial services to Mexico’s payments market which has a projected Compound Annual Growth Rate of 15.75% (2022-2027). It enables customers to make payments across several Latin American countries: Argentina, Colombia, Costa Rica, Brazil, and Peru as well as anywhere else in the world that accepts Apple Pay.

Customers can take advantage of Apple Pay’s advanced security technologies, such as Face ID and Touch ID, to ensure that each of their transactions is secure and protected. They will also be able to make online purchases, without the need to manually enter their payment and shipping information each time.

Alejandro Del Rio, Regional Director Latam at Paymentology: “The digital economy in Mexico has flourished post COVID-19, and with it has come newfound consumer demands around digital ways to pay. Our cutting-edge payment technology and Fondeadora's deep understanding of the needs of Mexican customers, has made us the perfect partners to lead the charge of the rapidly transforming financial services industry in Latin America.”

To find out more about Fondeadora: https://fondeadora.com/

To find out more about Paymentology: https://www.paymentology.com/

Ends

About Paymentology:

Paymentology is the first global issuer-processor, giving banks, fintechs and telcos the technology, team and experience to issue and process Mastercard, Visa and UnionPay cards across 50+ countries. The company currently has payments experts with deep, local market knowledge on the ground in more than 60 countries, across 14 time zones, guaranteeing 24/7, worldwide support. Its superior multi-Cloud Platform offering both shared and dedicated processing instances, vast global presence, and richer real-time data, set it apart as a leader in payments.

For more information visit https://www.paymentology.com/

About Fondeadora:

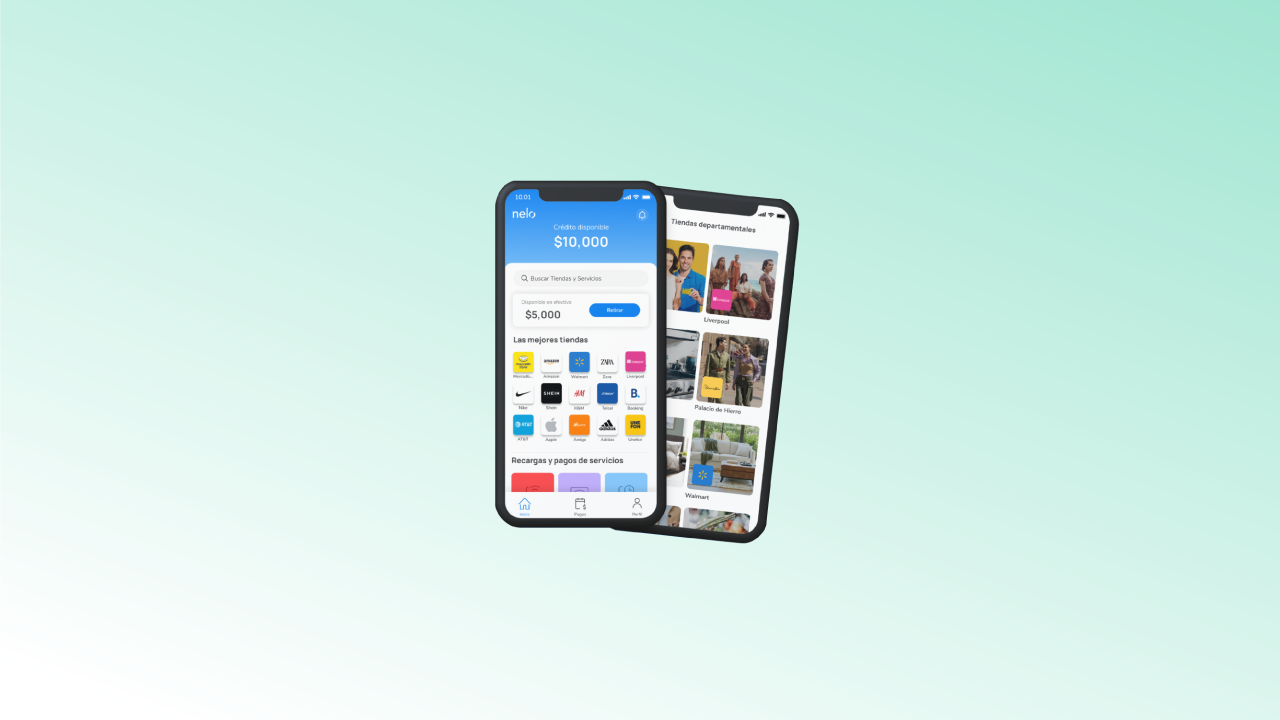

Fondeadora® by Apoyo Múltiple is a digital financial institution from Mexico that aims to empower individuals and businesses to take control of their finances. Our mobile app provides a seamless and intuitive user experience, allowing users to open accounts, deposit funds, and manage their money all in one place.

We believe that everyone should have access to financial services that are transparent, secure, and easy to use. That's why we committed to build a community of users who can benefit from our innovative platform and services.