Card Issuing Designed Around You

Launching a digital bank?

Expanding your fintech?

Elevating loyalty programmes?

Creating card programmes has never been simpler.

Drive growth with speed and flexibility

Our platform is designed for speed and flexibility, enabling you to launch faster and deliver value from day one. Configure with confidence.

Exceed customer expectations with powerful tools to define spending limits and controls, build loyalty and enable multi-currency transactions, all from one platform. Whether virtual or physical, your cards are built to drive engagement and growth.

How Paymentology drives success for businesses worldwide

See how businesses around the globe are using Paymentology’s platform to achieve incredible results:

Uncover how we can drive your business toward the same outstanding success.

The right card for every need

Whether it’s physical or virtual, Paymentology supports every type of card your business requires. Explore our versatile card options:

Cards designed for every industry

No matter your business, Paymentology’s platform delivers solutions that fit your industry’s unique needs. Operating in over 50 countries with local expertise, we ensure your card programmes are ready to succeed on a global scale.

Here’s how we help across industries:

Travel: Secure transactions for customers on the go, anywhere in the world.

Telecom: Enable integrated payment solutions within your ecosystem.

Remittance: Offer fast, reliable and secure money transfers.

Corporate B2B cards: Streamline business expenses, payroll and employee benefits.

Youth cards: Empower financial independence and smart spending habits

Global payment networks,

smooth integrations

Expand your reach with Paymentology’s unmatched connectivity. Our platform links your card programmes to the world’s leading payment networks, including Visa, Mastercard and domestic networks in over 60 countries.

We also integrate with essential third-party services to power your programmes:

Backed by these trusted networks and integrations, your card programmes are set up for success—anywhere in the world.

It’s no wonder so many leading brands trust Paymentology

for our card and payment solutions.

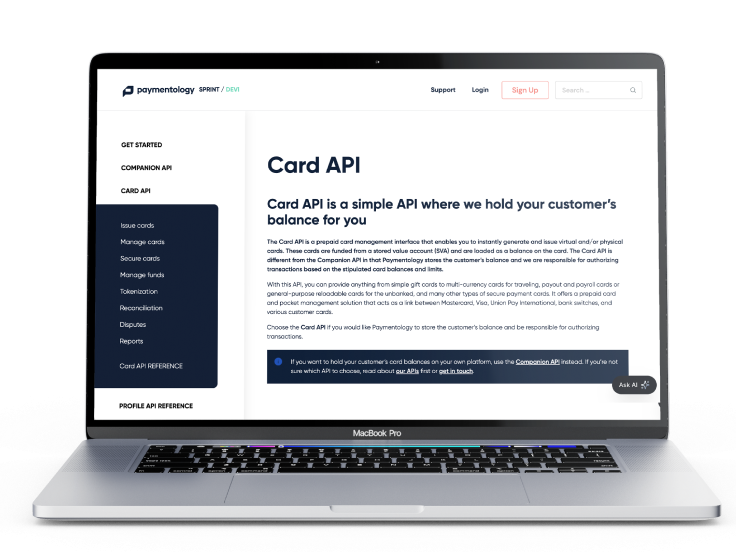

Build with Paymentology’s developer tools

Our robust API ecosystem empowers you to integrate essential services with ease. From onboarding credit bureaus to setting up fraud prevention systems, our Developer Portal provides everything you need to bring your vision to life. Explore detailed documentation, integration guides, and sample code to get started.

See it in action

Discover how easy it is to design, configure, and manage your card programmes with a live demo of our platform. Experience the intuitive interface and build your first card in real time.

Your guide to card programme success

Get access to our comprehensive guide packed with insights and best practices for managing successful card programmes.